7599 Redwood Blvd Ste 103, Novato, CA, United States of America, 94945

Feeds

Turrentine Market Update, July 2023

The Value of Experience

by Steve Fredricks

Over the past five decades, we have experienced and recorded numerous market cycles, enabling us to guide our clients in navigating fluctuating conditions with effective strategies. With today's challenging marketplace, the value of our experience is particularly crucial.

As we mark our 50 years in business, we remain steadfast in delivering the most precise and timely market information on bulk wine and grapes supply and demand. We draw from extensive active listings, recent deals, and years of navigating the complexities and emotions of market cycles to help you make informed decisions.

While this season may continue to be a slow market, we encourage you to adopt a realistic approach and make tough decisions on supply, so you are ready to capitalize on opportunities as they arise.

In this newsletter, we provide in-depth analysis on the bulk wine and grape markets for key varieties and regions. Our coverage includes trends in demand, price reductions, and an overview of the impact of weather patterns on the 2023 harvest.

Market Update

Bulk Market

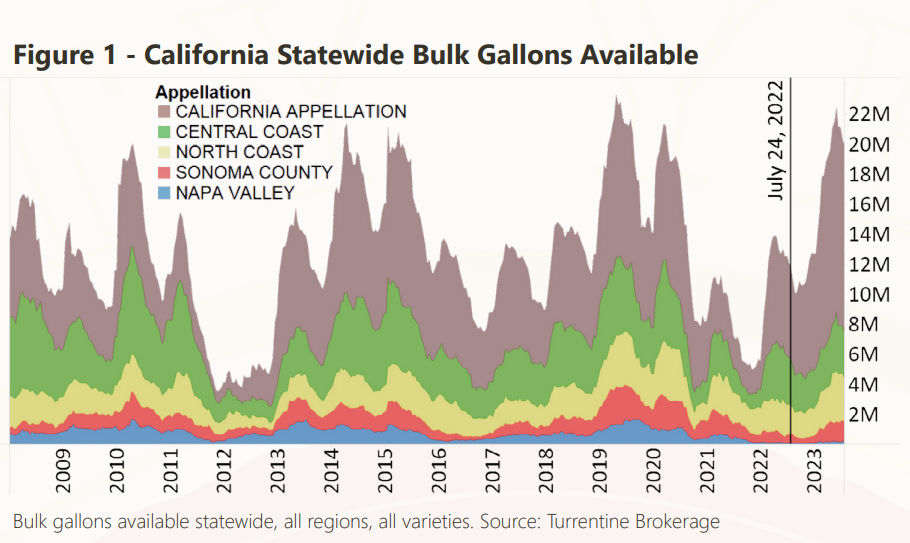

According to our latest analysis, the active listings for bulk wine in the state currently sit at approximately 19.9 million gallons, marking a decline of 2.5 million gallons from its peak in early June. This decrease is equally distributed between the 2021 and 2022 vintages.

As we progress through the season, it has become increasingly difficult to sell large volumes of bulk wine, even at significant discounts. A number of buyers are exhibiting patience, keeping an eye on the gradually lowering bulk prices at the value-end of the spectrum and the slow consumer sales for value wine. High quality alone may not be enough to stimulate a sale as there is still a lack of interest from buyers, despite offering larger volumes of bulk red wine at very attractive prices.

In these challenging and uncertain market conditions, it is crucial to be pragmatic and grounded. Holding out for a rebound in bulk prices for older vintage wines may not be the most reliable plan given the current supply of bulk wine available domestically and globally. Bulk prices are likely to decrease or hold over the next few months and less likely to increase.

Cabernet Sauvignon

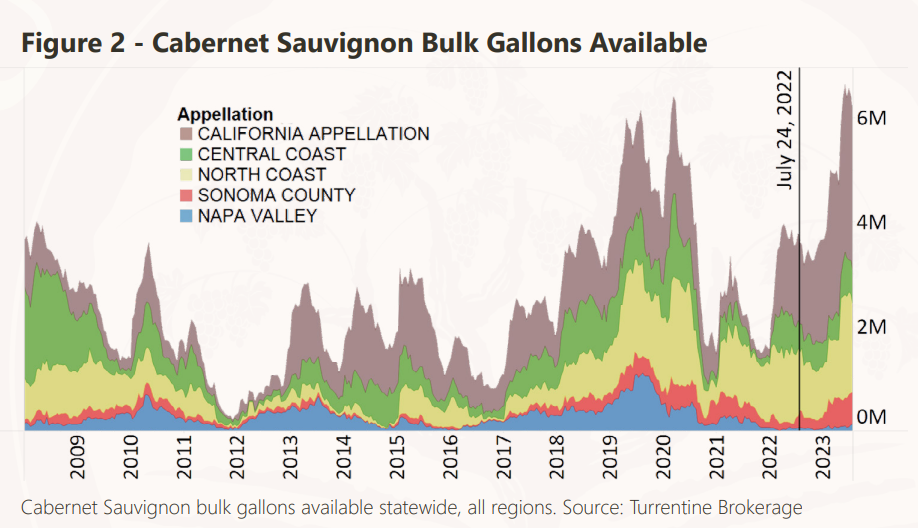

- Cabernet Sauvignon dominates the total bulk supply actively for sale, representing nearly 1/3rd of the overall gallons listed.

- Total V22 Cabernet Sauvignon gallons actively for sale have remained steady at approximately 3.5 million for the last couple of months.

- The most active market continues to be Napa Valley, and gallons have been relatively tight all year. Over the last few weeks, available gallons are staying on the market longer and volumes have crept upward as a result. There are just over 120,000 gallons on the market at the moment, virtually all of which is V21 or V22, and there will be additional opportunities of wine for sale over the next couple of months. Recent sales have been between $40.00 and $58.00 per gallon.

- Demand for Sonoma County and Paso Robles lots have been moderate of late, and asking prices have come down as the year has progressed. Buyers continue to be patient and are looking for smaller volumes. Figure 1 - California Statewide Bulk Gallons Available Bulk gallons available statewide, all regions, all varieties. Source: Turrentine Brokerage Cabernet Sauvignon bulk gallons available statewide, all regions. Source: Turrentine Brokerage Figure 2 - Cabernet Sauvignon Bulk Gallons Available Turrentine Brokerage | The Value of Experience | July, 2023 Page 4 of 8

- Recent sales of Sonoma County Cabernet Sauvignon have been centered around sub-appellations with recent sales between $17.00 to $25.00 per gallon.

- Buyers for larger volumes of Paso Robles Cabernet Sauvignon have been hoping for under $10.00 per gallon, but few sellers have been willing to come down at this point. Recent sales for smaller volumes have been between $11.00 and $16.00 per gallon.

- Lodi and California Appellation Cabernet Sauvignon lots continue to stay on the bulk market. There are now 1.5 million gallons of v22 and a robust 1.4 million gallons of v21 actively for sale. Recent offering prices have been under $4.00 per gallon and that has done little to increase interest in larger volumes from buyers.

- There are 1.7 million gallons of Lake and Mendocino County Cabernet Sauvignon lots available—1.1 million of which is V22.

- Sellers have come down on their asking prices in both California Appellation and Lake and Mendocino Counties, but this has yet to stimulate additional interest from buyers. For North Coast Cabernet Sauvignon specifically, it will likely take a price competitive with California Appellation or import options such as Chile or Australia to possibly move the wine before harvest. It will likely remain very challenging to sell wine in volume for the next few months, at least.

Chardonnay

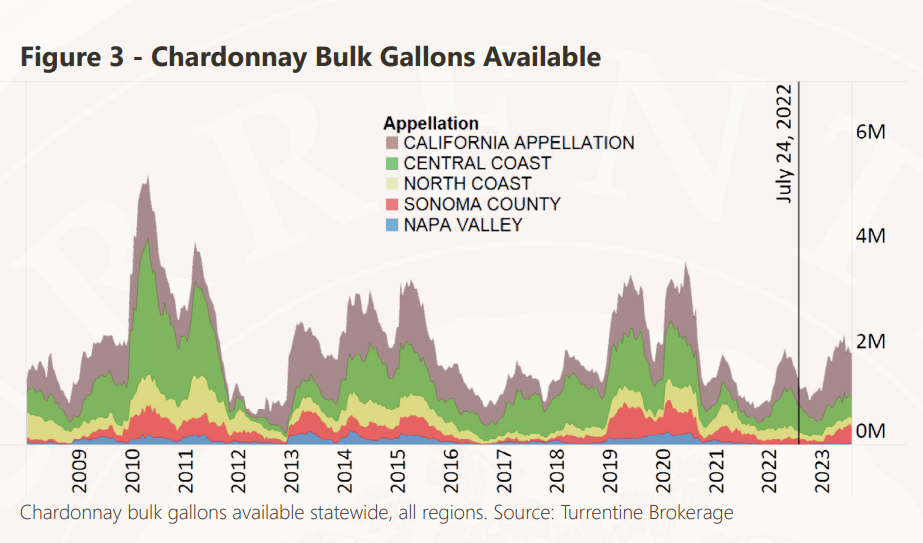

- The most active market for Chardonnay continues to be Sonoma County, namely Russian River Valley and Sonoma Coast. Recent sales have been between $18.00 to $22.00 per gallon, less than earlier in the year. Volume actively for sale has increased and wines are staying on the market longer.

- Demand has been soft for Central Coast Chardonnay and prices have come down over the last month. As harvest approaches and sellers are more motivated, recent sales have been between $4.50 to $10.00 per gallon.

- The North Coast bulk market is not as strong as Central Coast, and while we would expect sales prices to be in a similar range, there hasn’t been much activity.

- For both the Central Coast and North Coast, it will likely take a California Appellation price to move significant volume before harvest.

- Volumes of California Appellation Chardonnay have steadily decreased over the last month. Smaller volumes of wine have moved in the $7.00 and under range. Overall, demand remains soft even at asking prices below $4.00 per gallon.

Pinot Noir

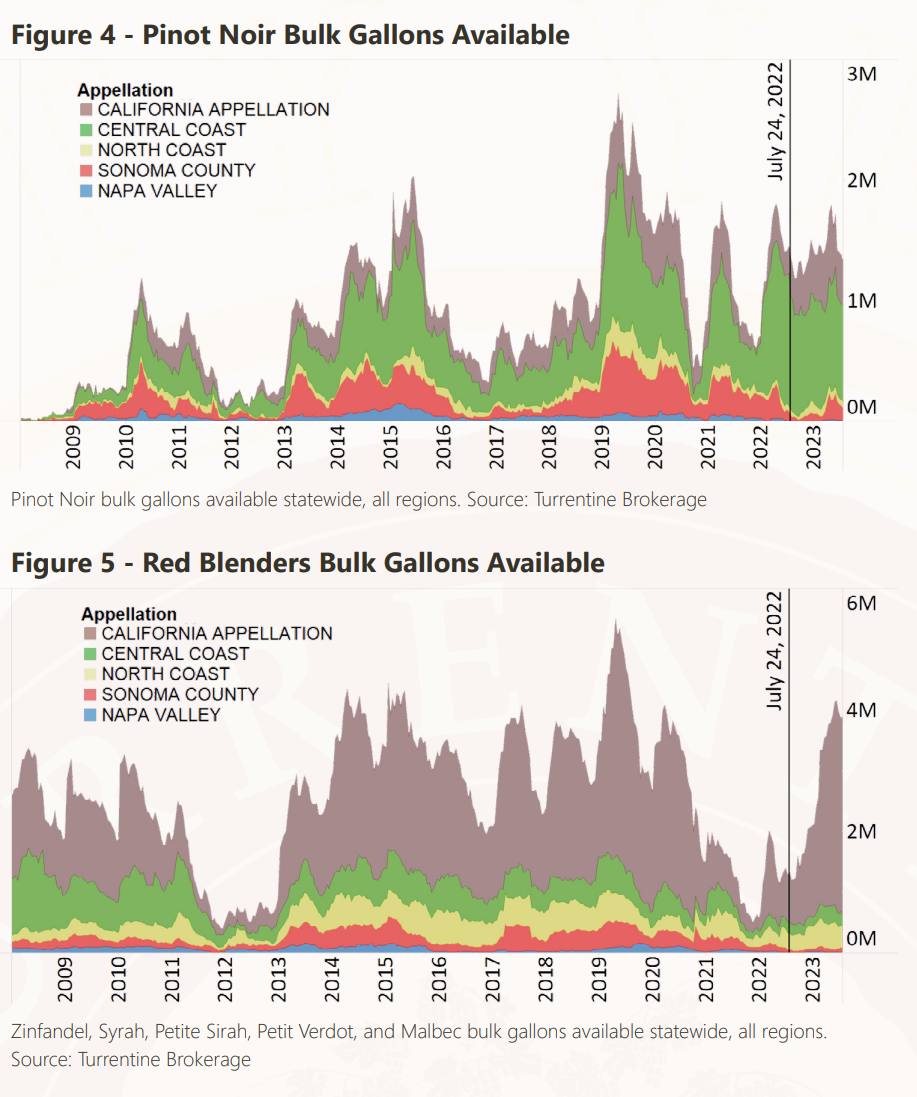

- The vast majority of demand statewide for Pinot Noir has been from Russian River Valley and Sonoma Coast—and demand has moderated for both. Recent sales have been between $16.00 to $22.00 per gallon.

- Demand remains very soft for Pinot Noir from other regions and any other coastal lots would likely need to be at a California Appellation price of roughly $5.00 to $7.00 per gallon, depending on volume, to potentially move larger volumes. It will most likely remain challenging to sell wine in volume for the next few months.

Red Blenders

Napa Valley red blenders, including Merlot, have been particularly tight with fewer than 20,000 gallons available with strong demand. Recent sales have been between $25.00 to $35.00 per gallon.

There is a bit more supply in Sonoma County than Napa Valley, and buyers have shown more interest of late. Demand is moderate and recent sales have been between $18.00 to $23.00 per gallon.

Demand for Paso Robles red blenders is fairly low, but there aren’t many gallons available either. Recent sales have been between $6.00 to $12.00 per gallon. • There are roughly 3.2 million gallons of California Appellation red blenders on the market from Zinfandel, Syrah, Petite Sirah, Petit Verdot, and Malbec, and very little demand to speak of.

It is likely to remain a buyers' market for Zinfandel, in particular, for some time.

Grape Market

North Coast

Thanks to the abundant winter rains, the canopies in the North Coast are stronger and healthier than they have been in years. Although early projections indicated an above-average yield, the extended winter rains negatively impacted bloom, resulting in poor set and shatter.

Despite these setbacks, crop estimates exceed those of previous drought periods and appear to be average, with the potential for change before harvest. Although the recent heat wave has accelerated crop maturity, vineyards are still behind schedule compared to previous years.

There is a strong demand for white varietals, particularly those from Sonoma County. Mendocino County's white varietals are experiencing moderate demand, which is significantly better than the low interest in red varietals from Lake and Mendocino County, aside from Napa Valley's reds.

Central Coast

The Central Coast harvest remains unpredictable and challenging to accurately estimate. While some grape blocks show potential for above-average yield, most fall in the average to slightly below category due to uneven sizing and low berry count. Our outlook favors an average crop for Central Coast, with exceptions in select areas such as Arroyo Seco Chardonnay and pockets of Pinot Noir in the northern Central Coast. The biggest market shift over the past two months has been traditional grape buyers becoming grape sellers themselves. This shift, coupled with the late growing season, has made for rough market waters in the Central Coast.

Overall, demand is sluggish for most grape varieties, although we have observed rising interest in smaller lots in Paso Robles in the past two weeks. While some wineries may be exploring larger volumes, it is uncertain how serious they are about pursuing it. Given that case good programs are struggling to meet depletion targets, it is unlikely that substantial demand for 2023 grapes will emerge any time soon.

San Joaquin Valley

Lately, the anticipated size of the 2023 crop in the San Joaquin Valley has decreased slightly. Despite early predictions of an above-average harvest, it is now expected to be only average-plus due to factors like shot berry, shatter, and cluster size. As a result, both buyers and sellers have adjusted their estimates accordingly. Additionally, vineyards are currently running behind last year by 10 days to three weeks, which may lead to compressed harvest schedules and pressure for timely picking. Furthermore, demand for these grapes has been slow since bloom, with new listings for grower-owned grapes emerging on a weekly basis.

While many growers were hoping their existing wineries would renew their contracts, this has not happened in most cases. As a result, wineries are now listing grapes as available, as most are either balanced or have an oversupply. This market condition makes it challenging to find buyers for grapes that are not currently under contract.

Conclusion

The world of bulk wine and grape markets is constantly evolving, which is even more evident during harvest season. This brings both challenges and opportunities that require a well-informed approach and quick decision-making. As we celebrate our 50th anniversary, our brokers' up-to-date market information and the experience we've gained over the years put us in a prime position to assist you in succeeding in the current market. Current advice to buyers: the lower prices at the value-end bring affordable opportunities. This is the perfect time to obtain quality wine at attractive prices. We invite you to reach out to us to discuss how we can help you maximize your potential in the current market. Current advice to sellers: we understand the urgency of moving your grapes and bulk wine. Even with updated and more accurate crop projections, grape and bulk wine buyers have not entered the market. Given the current markets, it's not only about the quality of your product, but also about pricing strategically. Let us assist you in finding the perfect balance that will incentivize buyers and provide you with a greater potential for sale. Consistent communication is vital to success. We encourage you to connect with us often, so we can provide real-time advice and ensure you're making the most informed decisions possible. Please don't hesitate to contact us for any questions, thoughts, or plans you'd like to discuss. Over the past five decades, we have encountered difficult cycles and celebrated successes with our clients, and together we will navigate this cycle as well.

About

Turrentine Brokerage sells winegrapes from all California regions and wines in bulk from California and around the world. Turrentine Brokerage serves as a trusted and strategic advisor to deliver customized solutions for growers, wineries and financiers based upon:

- In service since 1973

- A reputation for integrity

- Quick response to client needs

- Demonstrated expertise, with the most experienced team of brokers and analysts in the industry

- Brokering grapes and bulk wine Domestic and International

- Proven long-term strategies from exclusive and superior market information and proprietary research

- Unmatched expertise in long-term contracts

Grapes - Wines in bulk - Strategic planning - Global sourcing - Processing - Casegoods

Turrentine Brokerage is dedicated to helping the California wine business by supplying accurate information about supply trends and by providing win/win negotiations. The company works with most of the wineries in California, as well as with wineries in other states and with foreign purchasers of California wines. Turrentine Brokerage also assists many of the state's leading grape growers in marketing their grapes.

Tel: 415/209-9463 fax: 415/209-0079 Website: www.turrentinebrokerage.com

Contact

Contact List

| Title | Name | Phone | Extension | |

|---|---|---|---|---|

| President/Partner | Steve Fredricks | steve@turrentinebrokerage.com | 415-209-9463 | |

| Vice President/Partner | Brian Clements | brian@turrentinebrokerage.com | 415-209-9463 | |

| Broker/Partner - Grapes | Erica Moyer | erica@turrentinebrokerage.com | 415-209-9463 | |

| Broker - Grapes, North Coast | Mike Needham | mike@turrentinebrokerage.com | 415-209-9463 | |

| Broker/Partner - Bulk Wine | Steve Robertson | stever@turrentinebrokerage.com | 415-209-9463 | |

| Broker - Bulk Wine | William Goebel | william@turrentinebrokerage.com | 415-209-9463 | |

| Broker/Partner - Grapes, Central Coast | Audra Cooper | audra@turrentinebrokerage.com | 415-209-9463 | |

| Broker/Partner - Bulk Wine | Marc Cuneo | marc@turrentinebrokerage.com | 415-209-9463 | |

| National Sales Manager, Strategic Brands | Bryan Foster | bryan@turrentinebrokerage.com | 415-209-9463 |

Location List

| Locations | Address | State | Country | Zip Code |

|---|---|---|---|---|

| Turrentine Brokerage | 7599 Redwood Blvd Ste 103, Novato | CA | United States of America | 94945 |