100 Stony Point Rd. Ste. 160, Santa Rosa, CA, United States of America, 95401

Feeds

2024 Commercial Insurance Outlook

Good News & Challenges

The Insurance Market Cycle: Hard Versus Soft Markets

The commercial insurance market is cyclical in nature, fluctuating between hard and soft markets. These cycles affect the availability, terms, and price of commercial insurance, so it’s helpful to know what to expect in both a hard and soft insurance market.

A soft market, which is sometimes called a buyer’s market, is characterized by stable or even lowering premiums, broader terms of coverage, increased capacity, higher available limits of liability, easier access to excess layers of coverage, and competition among insurance carriers for new business.

A hard market, sometimes called a seller’s market, is characterized by increased premium costs for insureds, stricter underwriting criteria, less capacity, restricted terms of coverage, and less competition among insurance carriers for new business.

Recent History – A 2023 Retrospective

Throughout 2023, the commercial insurance space became an increasingly complex environment. There’s been both good news and challenges.

In some lines of coverage—namely, directors and officers’ liability (D&O), employment practices liability (EPL), and workers’ compensation—shifting market dynamics, new capacity, and optimal underwriting results set the stage for improved conditions, which means fewer rate increases and, in some cases, rate decreases.

On the other hand, headwinds facing other coverage segments, such as commercial property and automobile led to diminished profitability and fueled double-digit rate hikes.

Looking ahead, industry experts anticipate that the commercial insurance sector will still carry challenges in 2024; however, it may present more favorable conditions than it has in previous years for some insurance buyers and in certain lines of coverage. Yet, some coverage segments, including commercial property and automobile will likely remain difficult to navigate. Regardless, a proactive approach to risk management in securing adequate coverage will be critical in securing needed insurance during this time. The key will be to address the factors we can control in advance.

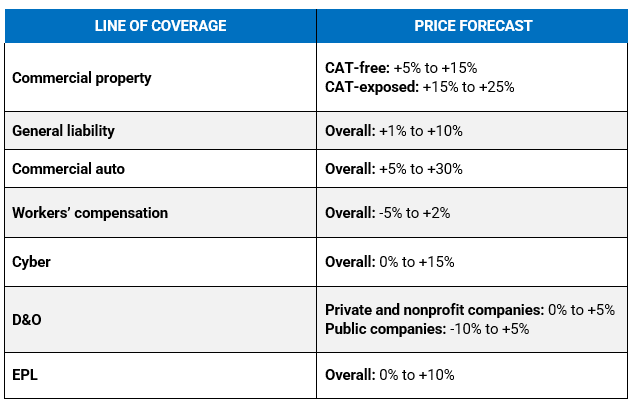

2024 Insurance Rate Forecast Trends

Price forecasts are based on industry reports and surveys for individual lines of insurance. Forecasts are subject to change and are not a guarantee of premium rates. Insurance premiums are determined by a multitude of factors and differ between businesses. Claims history will impact pricing and coverage availability. These forecasts should be viewed as general information, not insurance or legal advice.

Note: CAT refers to “catastrophic perils” such as wildfires, earthquakes, etc.

Your team here at Acrisure is ready to help. While the above predictions are based on expert research, they are subject to change. We encourage you to partner with us to learn price forecasts for your specific business and to set an insurance and risk management strategy that will maximize your protection and minimize cost. Let's have a conversation. Just reply here.

About

VANTREO Insurance Brokerage has been exclusively endorsed by five Sonoma County winery associations to provide all-lines of insurance in a special program that identifies coverage gaps through a full audit and almost always saves our clients money too. Our brokerage strives to be the "go-to" insurance brokerage for all wine and ag businesses. We have highly trained experts who have been credentialed in farm and ag designations and our agency has received the top credential from Nationwide/Allied, the largest ensurer of the wine/ag industry in the USA. We represent over 150 A rated insurance carriers for property & casualty, workers compensation, life/key-man insurance, health benefits, and crop insurance.

Our wine biz team is comprised of high level insurance and operational professionals who are educated, resourceful, creative and fun to work with. We bring the personal touch to our client relationships.

You may also want to know that we are

- a full service brokerage offering a broad range of property/casualty, employee benefit, financial services, personal insurance program, and risk management solutions;

- experts in working with rapid growth, multi-location, and risk challenged businesses

- California North Bay's Business of the Year in the mid-size category.

- voted North Bay Business Journal Best Place to Work for the past 2 years

- reducing workers compensation claims cost our CompZone division just passed the $1,000,000 mark in negotiated claim reserve reductions on our clients behalf

- originator of the annual Latinos in the Workforce conference which seeks best practices in addressing workplace diversity

- endorsed by several CA trade associations for exclusive products & solutions

- able to provide plenty of references as to the success of our approach

Our goal is to leverage your time in achieving the professional results you want.

License # 0F69776

Contact

Contact List

| Title | Name | Phone | Extension | |

|---|---|---|---|---|

| Vice President | Pam Chanter | pchanter@vantreo.com | 800-967-6543 | 223 |

| Assistant Vice President, Main Street | Joe Sucatre | jsucatre@vantreo.com | 800-967-6543 | 247 |

Location List

| Locations | Address | State | Country | Zip Code |

|---|---|---|---|---|

| VANTREO Insurance Brokerage DBA Acrisure West | 100 Stony Point Rd. Ste. 160, Santa Rosa | CA | United States of America | 95401 |